Even though the crypto market has a track record for undesirable conduct and scams, FTX held by itself up as one particular of the grown-ups. It lobbied for extra effective federal government regulation of crypto and made available to bail out other companies when they went bust.

Who owns it?

The organization was established in 2019 by Sam Bankman-Fried, improved regarded as SBF, and former Google staffer Gary Yang.

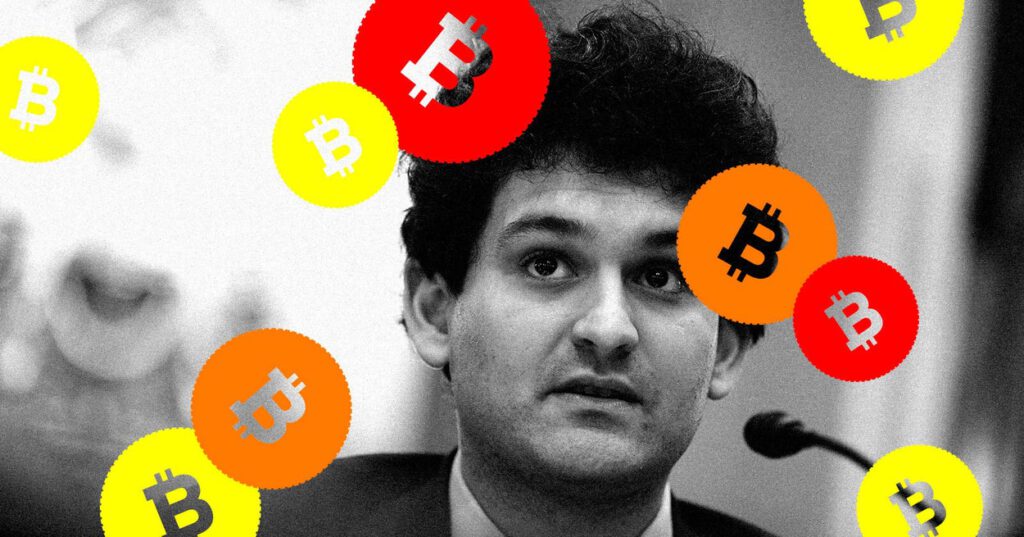

Bankman-Fried, who was CEO, is the 30-calendar year-aged son of two Stanford legislation professors. He graduated from the Massachusetts Institute of Engineering with a physics degree and expended time as a trader right before starting up FTX.

He soon turned just one of the richest guys in crypto, at just one level value some $26.5 billion. Recognized for his tousled hair and cargo shorts, he courted the push and was hailed as crypto’s “golden boy.” He defied regular CEO actions, participating in League of Legends all through small business phone calls and allegedly residing in a polyamorous team with 10 colleagues in the Bahamas.

Bankman-Fried was recognised as an adherent of the “effective altruism” movement — which asks adherents to choose their professions and steps to finest progress humanity — and established up a foundation to give his prosperity absent. He was also a main Democratic donor, promising to give absent $1 billion in the 2022 midterms, nevertheless he later walked back again that determination.

While FTX’s leaders have been Us citizens, including co-CEO and Republican donor Ryan Salame, the company was primarily based in the Bahamas. A nicely-acknowledged tax haven, the island place has lighter financial regulation, that means that FTX was able to do trades and market items to shoppers that it could not in the US.

What went improper?

In quick, FTX ran out of funds. Much more particularly, it ran out of its clients’ funds.

In addition to FTX, Bankman-Fried owned a crypto hedge fund named Alameda Investigation. The two firms are meant to be individual. This is particularly crucial simply because FTX managed resources belonging to shoppers.

However, on Nov. 2, crypto information web page CoinDesk claimed that Alameda held billions of pounds of a cryptocurrency produced by FTX. This led folks to concern how much funds was really in Alameda, and no matter if cash held in FTX was risk-free.

Bankman-Fried initially denied the report, stating in given that-deleted tweets that “FTX is fine” and was the target of rumors unfold by a competitor. Nevertheless, customers rushed to take out their funds from their FTX accounts. The very following day, Bankman-Fried announced that the firm was suffering from a “liquidity disaster,” indicating that persons were being asking for additional funds than FTX experienced readily available.

Could FTX have been saved?

When Bankman-Fried announced the crisis, he stated that the biggest crypto exchange, Binance, had expressed interest in buying FTX. This would indicate that clients’ cash would have been shielded.

On the other hand, Binance’s owner, Changpeng Zhao, claimed that the offer was subject to owing diligence. In the conclude, Binance withdrew from the offer. The organization tweeted that owing to “reports pertaining to mishandled buyer cash and alleged US agency investigations,” it would not rescue FTX.

On Thursday, Bankman-Fried tweeted out an apology: